Goldman Sachs Revises Global Music Revenue Projections

Goldman Sachs has recently revised its near-term outlook for the music industry for the first time since implementing this tracking methodology. According to an article from Billboard, the multinational investment bank and financial services company just lowered global growth expectations for the music industry for the next five years, as well as its forecast for global recorded music revenues this year. The latest Music In The Air report from Goldman Sachs now projects a compound annual growth rate of 6.8% from 2025 to 2030, a reduction from the previously anticipated figure of 7.6%.

The music business publication, Music Business Worldwide, stated that global revenues will expect to tip at $31.4 billion in 2025. Furthermore, the forecast for the period from 2031 to 2035 indicates a further slowdown, with an expected annual growth rate of 4.8%. The publishing revenue projections remain steady at $10.7 billion for 2025. In contrast, the live sector has experienced a modest upgrade, with expectations now set at $38.2 billion, an increase from the earlier estimate of $37.7 billion.

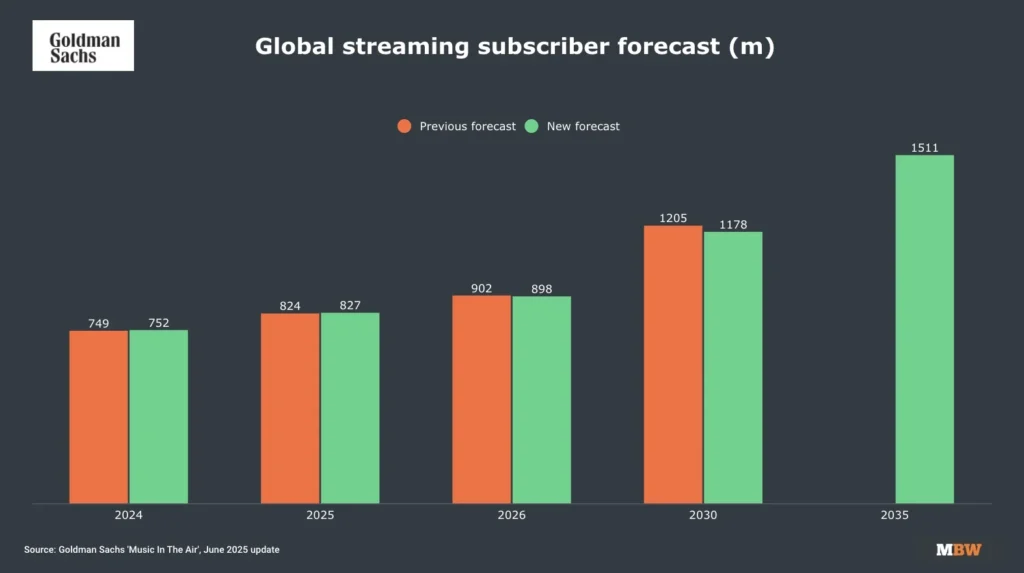

Also, music industry observers and financial analysts can note the most significant adjustment within the ad-funded streaming segment, which Goldman Sachs now estimates at $11.3 billion for 2025, reflecting a decrease of $2.1 billion from prior forecasts. Additionally, the subscription-based streaming sector has seen a slight decline, adjusting from $33 billion to $31.3 billion. Analysts have identified several key factors contributing to these changes, including a shift in user behavior away from long-form content, limited growth prospects from new platforms, and more measured expansion in emerging markets.

Goldmen Sachs revises how music industry revenue growth can improve projections

Furthermore, projections for streaming subscriber growth and average revenue per user have received a revision downward to align with these new expectations. While the report indicates that pricing adjustments and regional service differentiation may offer some long-term relief, there are no expections for them to fully counterbalance the short-term impact.

Despite these revisions, Goldman Sachs maintains a positive outlook regarding the structural resilience of the music industry. The long-term potential still connects itself to critical factors such as pricing power, opportunities for licensing expansion, and improved alignment between service design and consumer preferences.

Acknowledgement of AI’s role in generating revenue in current music industry trends

The report also acknowledges the rising influence of AI-generated music, noting that its current impact on royalties is relatively minimal, with AI tracks making up approximately 0.1% of the royalty pool. Advances in content identification and adjustments to royalty models are contributing to the management of this issue at present.

Overall, while the significant long-term revenue adjustments that Goldman Sachs made were not according to AI output volume, its role remains an important variable in future modeling. The firm emphasized that the technology could lead to either fragmentation or consolidation of revenue, depending on how streaming platforms and rights holders approach attribution, licensing, and monetization in the future.